Intro to Financial Accounting 1.0

Free Version

Publisher Description

Intro to Financial Accounting - Widen your financial accounting knowledge and enhance your career horizons.

Financial accounting (or financial accountancy) is the field of accounting concerned with the summary, analysis and reporting of financial transactions pertaining to a business. This involves the preparation of financial statements available for public consumption. Stockholders, suppliers, banks, employees, government agencies, business owners, and other stakeholders are examples of people interested in receiving such information for decision making purposes.

Financial accountancy is governed by both local and international accounting standards. Generally Accepted Accounting Principles (GAAP) is the standard framework of guidelines for financial accounting used in any given jurisdiction. It includes the standards, conventions and rules that accountants follow in recording and summarising and in the preparation of financial statements. On the other hand, International Financial Reporting Standards (IFRS) is a set of international accounting standards stating how particular types of transactions and other events should be reported in financial statements. IFRS are issued by the International Accounting Standards Board (IASB). With IFRS becoming more widespread on the international scene, consistency in financial reporting has become more prevalent between global organisations.

While financial accounting is used to prepare accounting information for people outside the organisation or not involved in the day-to-day running of the company, management accounting provides accounting information to help managers make decisions to manage the business.

Financial accounting is the preparation of financial statements that can be consumed by the public and the relevant stakeholders using either Historical Cost Accounting (HCA) or Constant Purchasing Power Accounting (CPPA). When producing financial statements, they must comply to the following:[6]

Relevance: Financial accounting which is decision-specific. It must be possible for accounting information to influence decisions. Unless this characteristic is present, there is no point in cluttering statements.

Materiality: information is material if its omission or misstatement could influence the economic decisions of users taken on the basis of the financial statements.

Reliability: accounting must be free from significant error or bias. It should be easily relied upon by managers. Often information that is highly relevant isn’t very reliable, and vice versa.

Understandability: accounting reports should be expressed as clearly as possible and should be understood by those to whom the information is relevant.

Comparability: financial reports from different periods should be comparable with one another in order to derive meaningful conclusions about the trends in an entity’s financial performance and position over time. Comparability can be ensured by applying the same accounting policies over time.

Profit and Loss Statement (also called Statement of Comprehensive Income)

In case of service organisations they are called as profit & loss a/c as income statement.

the profit or loss is determined by:

Sales (revenue) – Cost of Sales – total expenses + total income – tax paid = profit/loss

If there's a negative balance, it's a loss

if there's a positive balance, it's a profit

Statement of Financial Position (also called Balance Sheet)

The balance sheet is the statement showing assets & liabilities. As per the proforma, on its right it shows assets and on its left side it shows liabilities. It helps know the status of a company. The difference between current assets and current liabilities is called working capital. The assets are mainly divided into 2 types:

fixed assets and

current assets

The liabilities are

long term liabilities and

short term liabilities or current liabilities.

About Intro to Financial Accounting

Intro to Financial Accounting is a free app for Android published in the Office Suites & Tools list of apps, part of Business.

The company that develops Intro to Financial Accounting is Best Self Learning Apps. The latest version released by its developer is 1.0.

To install Intro to Financial Accounting on your Android device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2016-08-02 and was downloaded 5 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the Intro to Financial Accounting as malware as malware if the download link to com.best.self.learning.apps.free.introduction.financial.accounting.fundamentals is broken.

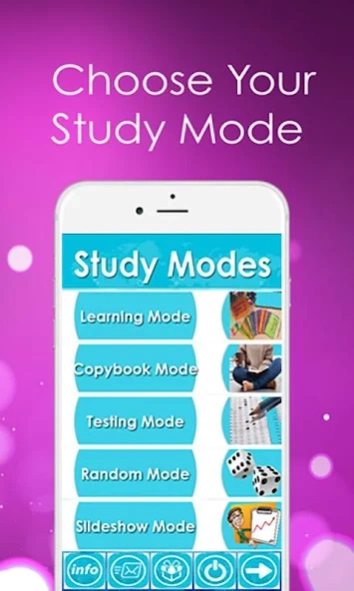

How to install Intro to Financial Accounting on your Android device:

- Click on the Continue To App button on our website. This will redirect you to Google Play.

- Once the Intro to Financial Accounting is shown in the Google Play listing of your Android device, you can start its download and installation. Tap on the Install button located below the search bar and to the right of the app icon.

- A pop-up window with the permissions required by Intro to Financial Accounting will be shown. Click on Accept to continue the process.

- Intro to Financial Accounting will be downloaded onto your device, displaying a progress. Once the download completes, the installation will start and you'll get a notification after the installation is finished.